td ameritrade taxes explained

TD Ameritrade Secure Log-In for online stock trading and long term investing clients. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099.

If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID.

. It provides 100000 in practice money along with access to a. Open an Account Now. Your statement from TD Ameritrade is organized by sections to give you all of the information you need to know about your account in a way thats simple to view and understand.

Open an Account Now. TD Ameritrade will assess and collect these taxes where applicable. Domestic and International outgoing wires- 5.

Or qualified foreign corporation. To send a secure message through the Online Banking Message Center. These types of profits are known as capital.

Replacement paper statement sent by US mail- 5. For example for long marginable equities priced over 1 the SRO is 25 percent. TD Ameritrade specifies the SRO requirement for each security.

This video shows you how to navigate to your TD Ameritrade Institutional website and find your 1099. Paper statement for accounts under 10000- 2. Select the Customer Service tab.

After a year of investing and trading its time to report your taxable investment income to the IRS. Taxes related to TD Ameritrade offers are your responsibility. Holding period requirements that must be met to be eligible for this lower tax rate.

Foreign Issuer Taxes - Certain foreign governments tax securities transactions regardless of where the security trades. After you fund your account you can place orders to buy and sell. The SRO is as low as 30.

Ad No Hidden Fees or Minimum Trade Requirements. Put simply a brokerage account is a taxable account you open with a brokerage firm. Log in to Online Banking.

A tax lot is a record. To help you do this your brokerage firm will send you. TD Ameritrades paperMoney virtual simulator is a desktop-based platform geared toward advanced and frequent traders.

Ad No Hidden Fees or Minimum Trade Requirements. TD Ameritrade Monthly Fee TD Ameritrade does not charge monthly fee on all of its accounts including all taxable individual or joint brokerage accounts all non-taxable individual. One of the main ways to profit from investing is to buy assets at one price and then sell them at a higher price.

TD Ameritrade will report a dividend as qualified if it has been paid by a US. Under Secure Message and Inquiries select. The broker charges you.

Form 1099 OID - Original Issue Discount. Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security.

It S Harvest Time Potentially Grow Your Savings Usin Ticker Tape

Td Ameritrade Review 2021 Real Estate Millions

Td Ameritrade Launches Tax Loss Harvesting Tool For Investors Business Wire

Looking Beyond Allocation For A Well Diversified Port Ticker Tape

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

5 Different Ways Td Ameritrade Makes Money Seeking Alpha

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

2022 Td Ameritrade Review Pros Cons Benzinga

Here S How To Minimize Taxes When Investing Youtube

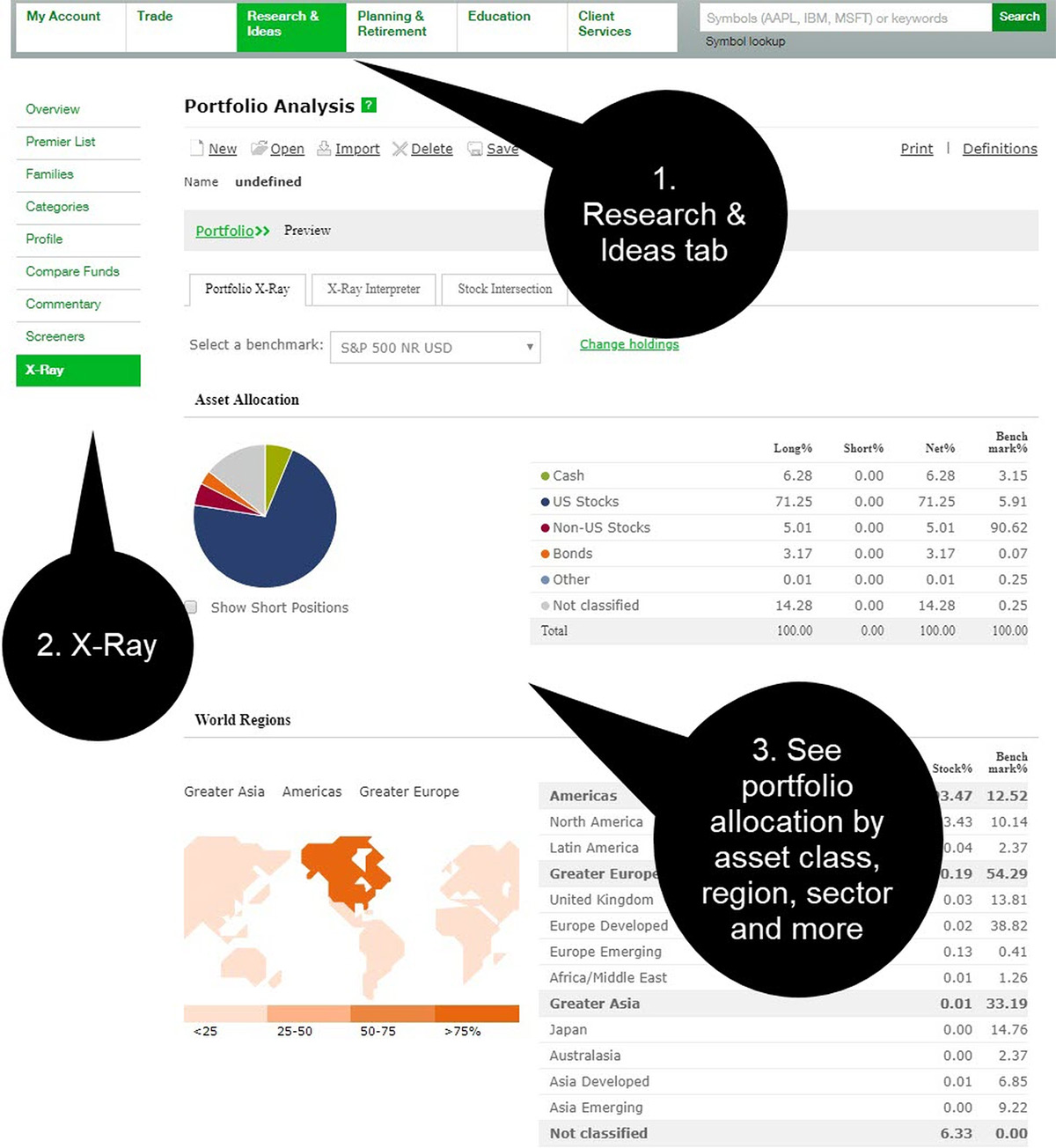

See Your Allocations From The Inside Out With Portfol Ticker Tape

Td Ameritrade Vs Robinhood Wall Street Survivor

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

Td Ameritrade Capital Gains Taxes Explained Facebook

Getting Started With Screeners How To Find Potential Ticker Tape

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)